Chapter 10

Data Science in Distribution and Logistics – Streamlining the Supply Chain

"It’s critical that we drive the digitization of supply chains because, without it, there will be no transparency; and without transparency, there will be no accountability." — Christian Lanng

In this chapter, we explored how data science is revolutionizing distribution and logistics across industries. We began by defining distribution and logistics and establishing how data-driven decision-making has become essential for optimizing supply chain performance. Next, we examined key data sources – from GPS trackers and IoT sensors to transactional systems and external feeds – that fuel modern supply chain analytics. We then delved into specific applications: route optimization algorithms and AI fleet management that streamline transportation networks; predictive maintenance techniques that minimize downtime of vehicles and equipment; and demand forecasting models and inventory optimizations that balance stock levels with customer needs. We saw how real-time dashboards and predictive risk analytics are providing unprecedented visibility and agility to supply chain managers. Throughout, real-world case studies illustrated these concepts in action: finance leveraging analytics for fraud detection, retailers using AI for precise forecasts and warehouse robotics, healthcare ensuring cold chain integrity with sensors, FMCG companies reducing waste with predictive models, and logistics providers accelerating last-mile delivery through AI. Finally, we looked ahead to emerging trends such as blockchain for supply transparency, increasingly autonomous supply chain operations driven by AI, and the push for sustainability using data analytics. In summary, this chapter provided a comprehensive view of how data science tools – from algorithms and machine learning to real-time data platforms – are enabling smarter, faster, and more resilient supply chains, delivering both efficiency gains and strategic advantages for businesses in the digital age.

10.1. Introduction to Data Science in Distribution and Logistics

Executives often forget that creating a stellar product is only half the battle; if it does not reach customers efficiently, profit margins and brand reputation can unravel with head-spinning speed. Distribution and logistics, therefore, stand as the backbone of any robust supply chain. Data science has evolved into a critical force within these realms, offering not just incremental improvements but transformational shifts in how we plan, move, and deliver goods globally. Before we dive into the nitty-gritty of AI, analytics, and hyper-optimized routing, let us clarify the scope of “distribution” and “logistics,” and then explore how data-driven insights can yield tangible bottom-line results.

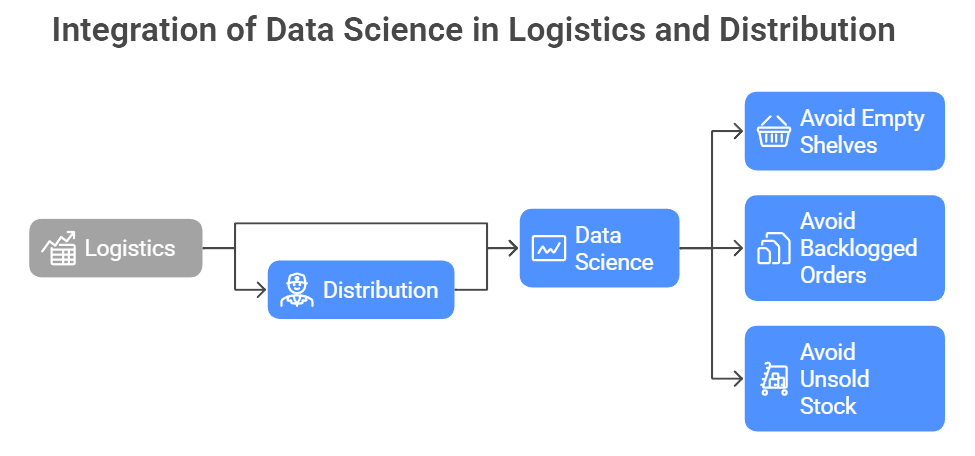

Figure 1: Illustration of the flow from logistics to distribution and then to data science, highlighting its role in preventing common supply chain issues. (Image by Napkin).

Distribution and logistics are in"Data science thrives on quantification and continuous feedback. Supply chain optimization is no exception, and many FMCG leaders ttertwined functions in supply chain management, yet each brings its own flavor. Logistics broadly encompasses the entire orchestration of goods movement and storage—everything from procuring materials to coordinating warehouses, ensuring deliveries arrive on time (Inbound Logistics). It embraces activities like transportation, inventory planning, and packaging, effectively serving as the “engine room” of the supply chain. Distribution is more narrowly focused on the final stretch: retrieving goods from storage, sorting or packaging them, and rushing them to customers’ doorsteps in the most efficient manner possible (Inbound Logistics). Think of logistics as the grand architect mapping out the entire flow of products, while distribution is the nimble foot soldier ensuring the last mile is handled with precision. In a highly competitive market, neither function can afford to rely on guesswork. Data science brings rigor and predictability to these processes, helping companies avoid nightmarish scenarios like empty shelves, backlogged orders, or mountains of unsold stock clogging valuable warehouse space.

In an age where consumers can switch loyalties with a tap on their smartphones, supply chains need to be as responsive as they are cost-effective. Data science steps in by harnessing information from every imaginable source—point-of-sale systems, IoT sensors, weather forecasts, social media chatter—to create a real-time mosaic of supply and demand (Role of Data and Analytics). With algorithms mining historical patterns, companies can forecast demand spikes more accurately than ever, thus dodging the dreaded bullwhip effect of overproduction and underproduction. Machine learning models can proactively alert planners to potential disruptions, such as a severe storm threatening a critical shipping lane or a sudden labor shortage at a key manufacturing hub. This heightened awareness translates into agility: organizations can reroute shipments, adjust production schedules, or ramp up contingency suppliers before a local hiccup becomes a global crisis (GJIA).

The strategic payoff of data science in logistics is startling. A McKinsey survey found that AI adopters in supply chain management cut logistics costs by around 15%, improved inventory levels by 35%, and boosted service levels (like fill rates) by up to 65% (GJIA). Those are not marginal gains—they are game-changers that can vault a business ahead of its competitors. It is no exaggeration to say that a data-blind approach to distribution and logistics in 2025 or beyond is akin to steering a ship with a blindfold on.

For any executive obsessed with metrics—and let us face it, most are—data science delivers a bonanza of meaningful KPIs. On-Time Delivery (OTD) and On-Time-In-Full (OTIF) rates climb when machine learning optimizes routing and scheduling, reducing customer complaints about late or incomplete shipments (Supply Chain KPIs). Perfect Order performance, which tracks how frequently orders arrive without damage or error, also sees significant improvement through better inventory accuracy and streamlined picking processes. Meanwhile, smarter forecasting leads to tighter inventory turnover, as goods do not linger in warehouses collecting dust (Supply Chain Analytics). Days of inventory on hand shrink, unlocking working capital that can be reallocated to more strategic investments.

Further down the chain, analytics can pinpoint bottlenecks in pick-pack operations or highlight underutilized warehouse space. Distribution managers gain visibility into real-time transit conditions, letting them adapt routes when traffic spikes or severe weather hits. Even softer metrics, such as customer satisfaction scores or net promoter scores, benefit when customers see that their orders consistently arrive promptly and in pristine condition. In essence, data science is less about fancy dashboards and more about fine-tuning critical levers—speed, cost, accuracy, and service—that define a thriving distribution and logistics operation (Supply Chain Analytics).

It may sound odd, but the finance sector also benefits from data science in distribution and logistics, particularly in preventing procurement fraud. By modeling transaction patterns and historical supplier data, machine learning algorithms can flag anomalous invoices or payments in real time (Journal of Informatics Education and Research). This safeguards operational spending and ensures that shady vendor relationships or inflated purchase orders do not slip under the radar. Because financial services often interface with complex supply chains—for instance, a bank supporting trade finance across multiple geographies—early fraud detection can save millions and preserve brand integrity.

Retailers live and die by their supply chains. Walmart, for instance, famously blends in-store data with e-commerce purchasing trends to refine daily forecasts, so products do not vanish from shelves when local demand surges (Supply Chain Dive). Amazon’s robotic warehouses are equally legendary: they rely on AI route planning and advanced robotics that zip around stacks of merchandise, drastically cutting order processing time (CDO Times). These systems are not just cute tech gadgets; they represent a seismic shift in how warehouses operate. Human labor is supplemented—some would say displaced—by machines that never get tired and can pick and pack items more quickly than even the fastest workforce. The end result is that retailers like Amazon can handle massive holiday rushes with far fewer errors and with barely a pause in operations.

The healthcare sector’s supply chain might be the last place an outsider expects to see real-time sensor data, but it is rapidly becoming a focal point. Companies transport highly sensitive items such as vaccines, blood products, or biologic drugs that must remain within a specific temperature range. IoT sensors embedded in packaging relay continuous temperature readings, allowing analytics platforms to raise an alarm if a shipment deviates from the safe range (Cold Chain Technologies). A single temperature excursion can render an entire batch useless, with both ethical and financial repercussions. Some biotech firms now automatically reroute shipments at risk, ensuring a replacement batch is already en route before patients or clinicians are left waiting (McKesson). Such agile responses not only save millions in product losses but also bolster confidence in public health supply chains.

FMCG supply chains feed the world—literally in the case of food and beverages—and data science cuts waste while raising shelf-life efficiency. Grocers employ predictive analytics to forecast sales for perishables. By factoring in everything from local weather to cultural festivals, companies can stock precisely enough fresh fruits, vegetables, or dairy without overordering (The Ecomm Manager). Online grocer Ocado uses millions of micro-predictions daily to anticipate exactly how many units of each product are likely to sell (Smith Business Insight). Shoppers find shelves consistently stocked, while store managers dramatically slash food waste. For any company grappling with razor-thin margins, a data-driven approach that eliminates expired produce or unsold inventory can be transformative.

Logistics providers—think UPS, DHL, FedEx—have perhaps the most direct perspective on how data science unlocks efficiencies. Last-mile delivery, which accounts for a colossal portion of shipping costs, is notoriously volatile thanks to traffic congestion, unpredictable delivery windows, and the geographical spread of customers. AI-driven route optimization now accounts for traffic density, weather updates, and daily order volumes, recalculating routes in real time (FarEye). UPS’s ORION platform reportedly saves over 10 million gallons of fuel per year, translating to hundreds of millions of dollars in cost avoidance (UPS AI Case Study). Such platforms not only keep transport budgets lean but also reduce carbon emissions—a crucial point for businesses facing rising consumer and regulatory pressure to become more environmentally responsible.

Distribution and logistics can no longer rely on “experience-based” planning alone. The complexity of modern commerce, global disruptions, and ever-rising customer expectations demand a data science approach that merges historical analysis, real-time monitoring, and predictive insights. From spotting subtle patterns of fraud in finance to orchestrating delicate cold-chain operations in healthcare, the same fundamental tools—machine learning, AI, robust data pipelines—continue to prove their worth. For leadership teams, the message is brutally clear: either embrace data science or brace for the marketplace to leave your supply chain in the dust. While adopting advanced analytics may require upfront investments in infrastructure, talent, and culture shifts, the payoff—measured in lower costs, happier customers, and fewer inventory nightmares—makes it one of the smartest bets in the fast-evolving commercial landscape.

10.2. Key Data Sources for Supply Chain Analytics

Data science initiatives thrive on a constant flow of relevant, high-quality information. Supply chains are no exception. Without comprehensive data streams capturing each link in the logistics chain—from inbound raw materials to final-mile deliveries—no machine learning algorithm or real-time dashboard can magically produce valuable insights. In many ways, data is the oxygen that fuels predictive models, prescriptive analytics, and the day-to-day decisions of supply chain managers. Leaders who appreciate this reality take deliberate steps to integrate data from a variety of sources, both internal and external, ensuring that their analytics strategy rests on a solid foundation rather than a patchwork of half-measures. What follows is an examination of the most vital data streams in modern supply chains, alongside practical discussions of how each can be collected, cleaned, and put to strategic use.

Few aspects of supply chain management are as nerve-racking as wondering whether a high-priority shipment is stuck in traffic or delayed by unforeseen road closures. GPS location data from delivery fleets brings unprecedented visibility and peace of mind, transforming guesswork into near real-time oversight. Modern telematics systems continuously transmit each vehicle’s coordinates, speed, and route, creating a granular record of transit performance (IT Supply Chain). These feeds allow managers to spot early signs of delay—such as traffic congestion around a major highway—so they can warn customers or pivot to alternate routes when possible. Some organizations have layered predictive algorithms atop these data streams to forecast exact arrival times, reducing the old “8 AM to 6 PM” delivery window that made end customers cringe.

Collecting and cleansing this data is not always trivial. GPS signals may get lost in tunnels or dense urban canyons, and driver input errors can distort route logs. A robust analytics platform must therefore include data validation routines to smooth out spurious readings. Data engineers typically create pipelines that unify GPS output from different vehicles and carriers into a standardized format. This ensures that a single supply chain control tower can display truck #5 and vessel #22 side by side, even if they originate in different countries or operate on dissimilar hardware. Once refined, these data feeds become the nervous system of a responsive supply chain, enabling dynamic re-routing, automatic customer alerts, and continuous improvement in delivery planning. In a hyper-competitive market, failing to invest in real-time vehicle tracking is like neglecting to install windows in a warehouse—managers remain in the dark about what is happening just outside.

The Internet of Things (IoT) is rapidly moving from buzzword to practical necessity in logistics. Sensors attached to machinery, vehicles, and even packages themselves generate a wealth of metrics that reveal how assets are performing and whether shipments remain within specified conditions. Organizations harness these sensor readings to power predictive maintenance strategies, spotting issues before they escalate into costly breakdowns. For instance, if a truck’s vibration profile diverges from its historical norm, machine learning models might suggest that a bearing is about to fail, prompting a quick stop at a nearby service center instead of a traumatic roadside emergency (Geotab). By proactively addressing these anomalies, companies not only save on repair costs but also reduce unplanned downtime that can throw entire delivery schedules off balance.

In cold chain logistics, sensors monitoring temperature and humidity inside packages can make the difference between a fully intact shipment and a catastrophic waste of perishables (Cold Chain Technologies). An out-of-range temperature reading may trigger an alert for immediate action, such as rerouting to a closer distribution hub or adjusting cooling protocols. The data’s integrity is paramount; a disconnected sensor can yield false positives or fail to detect a real breach. Thus, organizations must implement redundancy—multiple sensors or backup communication channels—to ensure reliability. Once raw sensor data is collected, data scientists often apply anomaly detection algorithms to filter out trivial fluctuations while highlighting genuine deviations that matter. This combination of IoT hardware, automated alerts, and predictive analytics forms a safety net that tangibly lowers risks and costs.

While IoT data tracks physical assets, enterprise systems capture the financial and operational heart of the supply chain. ERP platforms record orders, invoices, production volumes, returns, and every other transactional detail that crosses an organization’s operational path. These historical records act as the backbone of demand forecasting: by analyzing patterns in past orders—alongside marketing promotions, holiday peaks, or even competitor activities—data scientists can train models to anticipate how demand might evolve in future weeks or months (Cogent Blog). Advanced techniques, such as machine learning with gradient boosting or deep learning architectures, often outperform simpler statistical methods when the dataset is rich with predictors (for instance, embedding external signals like macroeconomic trends or social media sentiment).

Yet, building robust demand forecasts goes beyond just choosing an impressive algorithm. Data wrangling and cleaning remain unglamorous but essential tasks. Duplicate entries, incomplete fields, or inconsistent product codes between systems can degrade predictive accuracy. Cross-functional collaboration is typically required: data engineers harmonize input formats, domain experts confirm the logic behind product groupings, and IT staff ensure secure data pipelines that feed the final forecasting model. Once validated and aggregated, these historical transaction logs become invaluable not only for anticipating demand but also for fraud detection (DataScienceCentral.com). Abnormally large, repeated, or out-of-pattern orders can raise red flags, prompting further investigation. In some cases, supply chain teams discover questionable vendor relationships or inflated invoices that, left unchecked, could lead to financial hemorrhage (Journal of Informatics Education and Research). Taken together, transactional data is both a predictive goldmine and a guardian against fraudulent activities.

Warehouses and distribution centers pulse with activity: items arriving, being scanned, stored, relocated, picked, packed, and shipped out again. Every barcode scan, status update, or cycle count in a WMS contributes to a real-time picture of stock levels and product flows. Data scientists leverage this stream of information to optimize slotting (placing popular items closer to shipping bays, for instance), forecast reorder points, and reduce the dreaded stockout scenario (Supply Chain Analytics). Combining WMS data with demand forecasts can yield targeted reorder strategies, adjusting safety stock levels in near real time based on product velocity and lead times. The result is often a drop in carrying costs—since inventory is more tightly controlled—and an uptick in fill rates, delighting both internal sales teams and external customers.

In advanced or automated warehouses, IoT sensors on picking robots and conveyor belts produce additional data on operational efficiency (AI in Warehouse Management). These logs can show how long a robot spends traveling down certain aisles or whether congestion forms in high-traffic zones. Analysts then simulate alternative layouts, test different picking sequences, or even reconfigure the entire warehouse to minimize travel distances. It sounds straightforward, but the complexity can be immense—especially when thousands of SKUs and dozens of inbound and outbound trucks are in constant motion. Consequently, many organizations adopt a continuous improvement mindset, making iterative changes to layout, workflows, and automation settings, guided by data-driven experiments. The success stories typically see shorter fulfillment times, fewer picking errors, and a happier, less stressed workforce.

For all the marvels of internal data, supply chains do not operate in a vacuum. Weather events, economic fluctuations, or sudden shifts in consumer sentiment can ripple through global logistics networks with surprising force. Incorporating external data can dramatically boost the relevance and accuracy of predictive models (IT Supply Chain). A major storm on the East Coast might paralyze highway traffic, prompting a real-time route change or a quick pivot to rail. Commodity price swings may foreshadow cost changes, triggering procurement teams to lock in prices before they escalate. Even consumer chatter on social media can offer early clues to upcoming demand surges, such as a new health trend that leads to a run on plant-based protein products.

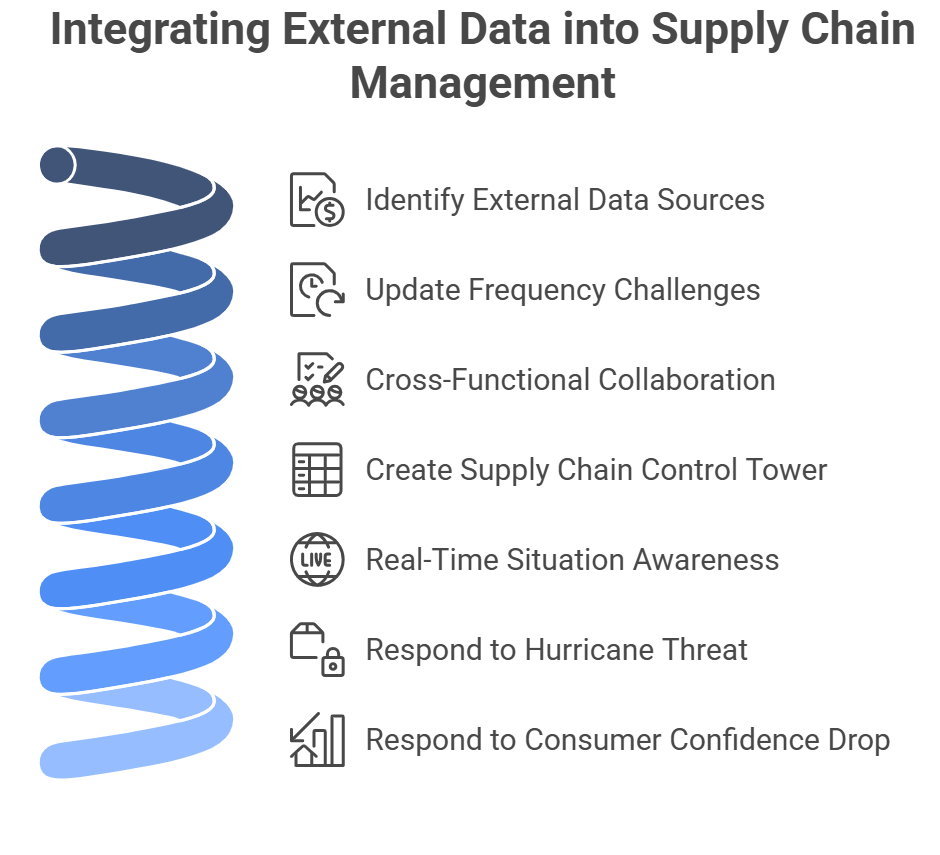

Figure 2: Illustration of the steps involved in leveraging external data for supply chain management, including challenges and responses to external events. (Image by Napkin).

Integrating external data is rarely seamless. Weather APIs may update hourly, while economic indices might refresh monthly, complicating how and when they get woven into models. Furthermore, cross-functional collaboration becomes critical. Supply chain planners need to confirm with marketing or finance colleagues that a certain index truly correlates with demand, as opposed to chasing spurious signals. When done right, a supply chain “control tower” emerges, fusing internal ERP transactions, WMS logs, and external feeds to paint a real-time picture of constraints and opportunities (Supply Chain Visibility). If a hurricane threatens a coastal port, managers can divert shipments preemptively; if consumer confidence plummets, they can tighten inventory to avoid overstock. By melding external and internal sources, organizations become nimble enough to roll with the punches of an unpredictable market.

Supply chain analytics succeed or fail based on the completeness, accuracy, and timeliness of the data being fed into the system. No matter how advanced your algorithms, they are doomed to mediocrity without high-quality GPS coordinates, IoT sensor readings, transactional history, warehouse logs, and external market signals to back them up. Executives who want real-time visibility, predictive power, and genuine operational transformation must treat data acquisition and governance as strategic imperatives. That often involves investing in sensor hardware, refining ERP structures, forging partnerships with external data providers, and cultivating a culture that values data-driven decision-making over gut instincts. It also demands robust data cleaning processes, data engineering capabilities, and a willingness among cross-functional teams—data scientists, IT staff, warehouse managers, and business strategists—to work in unison.

When an organization fully embraces these steps, the payoff can be enormous. Supply chains become agile, able to respond to unexpected disruptions or demand swings in near real time. Inventory holding costs shrink, while customer satisfaction grows. Predictive maintenance slashes downtime, and intelligent route optimization curtails delivery delays. The final outcome is a supply chain that is more cost-effective, more resilient, and better aligned with the demands of a fast-moving global economy. For those who still believe data science is purely theoretical, the tangible improvements in speed, margin, and customer loyalty often speak louder than any corporate buzzword. Ultimately, robust data sources form the backbone of a modern supply chain, turning daily operations into a competitive advantage rather than a recurring nightmare.

10.3. Route Optimization and Fleet Management

Data science in logistics sometimes feels like an overhyped buzzword—until you see a fleet slash hundreds of thousands of miles from its routes and save millions of dollars in the process. Route optimization and fleet management stand at the forefront of these gains, turning disjointed deliveries and guesswork-driven dispatches into highly choreographed networks of vehicles that serve customers faster and at lower cost. Executives often learn this the hard way, after watching fuel expenses balloon or on-time delivery metrics sag beneath the weight of poorly planned routes. Yet modern algorithms and AI systems offer a way out, using advanced mathematics and real-time data to eke out efficiencies once thought impossible.

Finding the shortest path between two points is a classic problem in computer science, but supply chains rarely stop at “two points.” Instead, a single vehicle may need to visit dozens of drop-off locations, each with unique constraints like delivery time windows or height restrictions. This challenge is where route optimization algorithms step up. Dijkstra’s algorithm, for example, has long been a go-to tool for identifying the shortest route in a weighted graph (G1192). Translated into logistics, those “weights” are distances or travel times between distribution centers, stores, or end consumers. Studies have repeatedly shown that systematically applying Dijkstra’s or a comparable approach can reduce total mileage by 7–9%, cutting not just fuel costs but also labor hours (G1192). A handful of percentage points may not sound revolutionary until you multiply them by a fleet of hundreds or thousands of vehicles.

More modern algorithms like A\ (A-star) build on these fundamentals with heuristics that expedite pathfinding (G1192). GPS navigation providers commonly rely on A\, as it can more quickly discard unpromising routes, returning an optimal path in less time. When you layer in complexities like vehicle capacity or time windows—for instance, the requirement to deliver perishable goods before they spoil—companies often turn to advanced variations of the Vehicle Routing Problem (VRP). Specialized solvers juggle multiple constraints, optimizing not just for distance but also for factors like driver shifts and docking availability at warehouses. The net effect is that organizations can instantly evaluate millions of route permutations and select a plan far superior to anything a human dispatcher could sketch out in a spreadsheet.

Behind the scenes, data quality remains crucial. It is no use having the best VRP algorithm if the underlying map data is riddled with errors or your distribution center addresses are incomplete. Many firms launch route optimization projects only to discover their location data is inconsistent across different IT systems. In these cases, the first step is data cleansing—ensuring addresses, road networks, and distance matrices are accurate. Once that foundation is in place, route optimization can bring about real-time or near-real-time planning capabilities, letting a dispatcher recalculate routes on the fly when a driver calls in sick or an urgent last-minute order arrives.

Route optimization alone is just the opening act. Modern fleet management goes further, harnessing AI to handle tasks like dynamic dispatching, predictive maintenance scheduling, and driver performance coaching. By analyzing telematics data—fuel consumption, idle time, acceleration patterns—a machine learning model might detect which drivers consistently burn more fuel than their peers on identical routes. It can then suggest coaching sessions to curb aggressive driving habits, not only saving on fuel but also reducing vehicle wear and tear (Best Route Optimization Practices with AI for Freight - Innofied). In another scenario, the AI might notice that a particular type of urban route is best served by two smaller trucks instead of one large vehicle, ultimately reducing congestion-related delays.

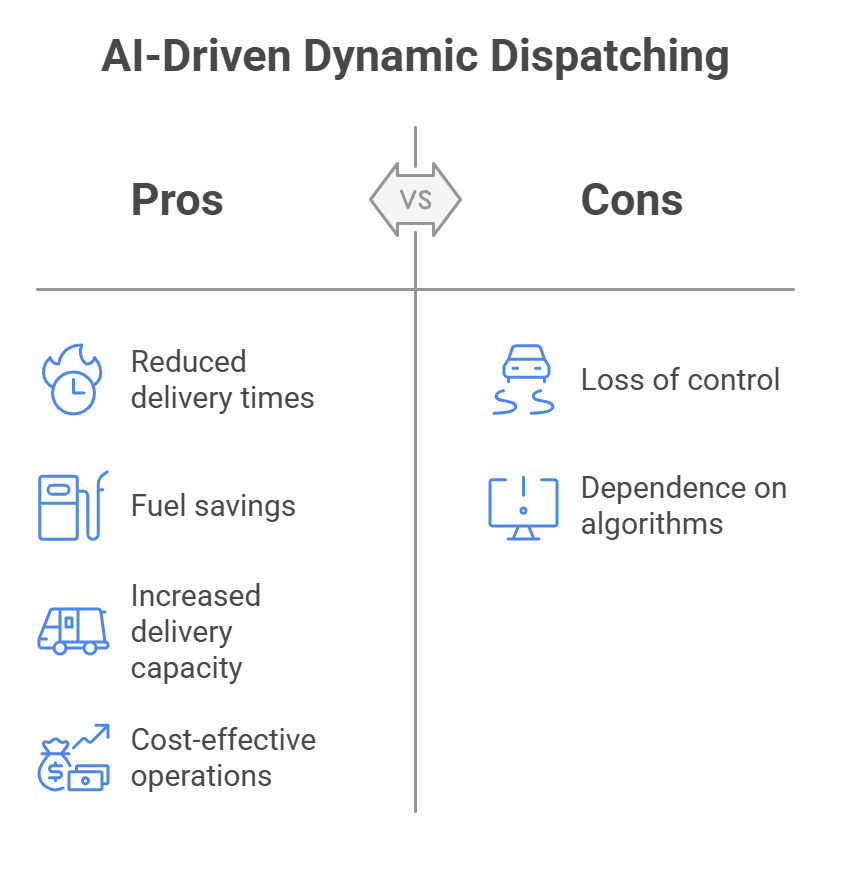

Figure 3: Illustration of AI-driven dynamic dispatching's pros and cons, detailing how it can lead to improved efficiency and cost-effectiveness while acknowledging the risks of losing operational oversight and relying heavily on automated systems. (Image by Napkin).

Dynamic dispatching represents one of AI’s most visible impacts. Rather than fix route assignments a day or week in advance, the system can reassign deliveries to whichever driver is best positioned at that moment. If a last-minute high-priority delivery request comes in, the algorithm quickly identifies which driver can handle it with minimal detour. These on-the-fly decisions become essential in e-commerce environments where consumers expect same-day or even same-hour delivery. One e-commerce giant that implemented AI-based route optimization reported trimming average delivery times by 30% and saving millions in fuel expenses (Innofied). A separate logistics firm cited a threefold increase in daily deliveries, along with a 35% reduction in fuel and maintenance costs, after adopting an AI-driven dispatching platform (Shift AI). While skeptics might worry about ceding too much control to algorithms, the consistent outcome of these case studies is a smoother, more cost-effective operation.

UPS offers perhaps the most famous success story with its ORION (On-Road Integrated Optimization and Navigation) system. By 2016, ORION had optimized routes for tens of thousands of drivers, collectively eliminating 100 million miles of travel each year (UPS AI Case Study). The resulting fuel savings—exceeding 10 million gallons annually—translated into avoided costs of $300–$400 million. That is the kind of metric that makes even the most conservative CFO take notice. Moreover, the environmental benefits are substantial, highlighting how AI-driven route planning can contribute to corporate sustainability goals.

Another real-world example is a large postal service that switched to algorithmic routing and saw on-time deliveries jump by 8% within a single year. The improvement stemmed from better route sequencing, fewer missed time windows, and more predictable vehicle usage, freeing managers to handle exceptions like severe weather more calmly. Meanwhile, startups like Shift AI have showcased how smaller fleets can reap similar benefits. In one instance, a government fleet improved its operational efficiency by 5× after adopting AI-based route planning and real-time asset tracking (Shift AI). Whether the fleet size is 10 vehicles or 10,000, the same core principle applies: mathematics and machine learning beat manual planning nearly every time.

Then there is Amazon, which has built its entire brand identity around lightning-fast deliveries. Much of this capability rests on intricate route optimization that factors in everything from traffic congestion to consumers’ home availability windows. The company reportedly invests heavily in advanced software that continuously recalculates driver routes, and it is even exploring drone deliveries to shorten the last mile. While the feasibility of drone-based shipping is still up for debate, the underlying push toward constant, data-driven innovation remains instructive for any logistics operation aiming to stand out in a competitive marketplace.

Regional examples abound as well. A mid-sized courier in Southeast Asia consolidated deliveries by neighborhood, cutting average delivery time by 25% and boosting driver productivity. By adopting a straightforward AI tool to cluster orders in adjacent areas, the courier reduced miles traveled and improved consistency in delivery windows (Innofied). Such stories prove that advanced route optimization and AI management are not solely for juggernauts like UPS or Amazon. Even small players can achieve remarkable efficiency gains if they commit to data integrity, adopt proven algorithms, and maintain a culture willing to trust algorithmic insights.

Leaders might ask: why do some route optimization projects flounder while others thrive? The first pitfall typically lies in data readiness. Inaccurate addresses, incomplete vehicle capacity data, or failing to integrate with real-time traffic feeds can undermine even the most sophisticated algorithm. A second challenge is organizational resistance: drivers might be wary of new software dictating their routes, or dispatchers might resent perceived encroachment on their expertise. Communication and training are critical to overcome these hurdles. It helps to show quick wins—like a route plan that slashes miles—so that frontline teams see tangible benefits early on.

A third factor is cross-functional alignment. Route optimization and fleet management do not exist in a silo. They overlap with sales (which promises delivery windows), IT (which integrates telematics data), and finance (which tracks fuel and labor costs). Bringing these stakeholders to the table ensures that AI solutions account for real-world constraints and do not deliver theoretically optimal but practically unworkable plans. Consider setting up a steering committee that includes data scientists, operations managers, and executive sponsors who can champion the project’s strategic importance.

Finally, iterative improvement is key. The best route optimization systems do not stand still; they feed on fresh data daily or even hourly, recalibrating models as traffic patterns, fuel prices, or warehouse capacities shift. Early results might be modest—shaving off a few percent in distance or time—but continuous refinement, guided by user feedback and ongoing analysis, can push gains far beyond the initial deployment.

Executives who still believe in shipping schedules scribbled on a whiteboard or “going with a hunch” on how to allocate trucks are, quite frankly, flirting with inefficiency. Route optimization and AI-driven fleet management offer a direct line to tangible gains in cost reduction, speed, and reliability. Dijkstra’s algorithm, A\*, and more advanced VRP solvers may appear intimidating, but the payoffs speak for themselves: fewer miles, reduced fuel consumption, more on-time deliveries, and happier customers. Companies from UPS to smaller regional couriers show that these technologies are not science fiction but everyday logistics reality. Embracing advanced routing and fleet management tools does require investment in data quality, robust IT integration, and organizational buy-in. Yet for those bold enough to take the plunge, the route forward is, quite literally, optimized.

10.4. Predictive Maintenance in Logistics

Predictive maintenance is rapidly emerging as a game-changing capability within logistics. No executive relishes the sight of a broken-down truck blocking a highway—worse still if that truck is loaded with time-sensitive goods. Yet, for decades, maintenance strategies in supply chains have been dictated either by rigid schedules (replace this part every six months, whether it needs it or not) or by frantic firefighting after a breakdown occurs. Data science introduces a more elegant alternative: monitor real-time signals from IoT sensors, detect early warning signs of impending failures, and then schedule repairs at precisely the right moment to keep everything humming. The approach can sound idealistic, but when done correctly, it is a proven method for driving down costs, reducing downtime, and—frankly—keeping your supply chain from devolving into a series of expensive surprises.

In a modern logistics environment, the sheer array of equipment is staggering: trucks, cargo vans, forklifts, automated sortation systems, conveyor belts, and more. The unifying thread is that each can be outfitted with sensors to measure operational health. These sensors generate streams of data on temperature, vibration, pressure, brake pad thickness, oil quality, or any other relevant parameter (Geotab). It is not uncommon for a single long-haul truck to produce gigabytes of telemetry monthly. Historically, much of this data went unused or was only analyzed post-mortem (for instance, after a catastrophic axle failure). Predictive maintenance flips that timeline around.

For example, a logistics company might notice that a slight uptick in axle vibration at a specific frequency often heralds a wheel bearing failure within a few weeks (Geotab). Instead of waiting until the truck breaks down on a remote highway, managers can schedule a bearing replacement during planned downtime, preventing both driver frustration and late deliveries. Similar principles apply in warehouses, where conveyor belts can develop subtle anomalies—like rising electric current draw—that foretell a motor failure. By tuning predictive models to catch these signals, facilities can orchestrate repairs in a controlled manner. One logistics firm found that this proactive approach cut total downtime by 40%, a staggering figure that translates directly into uninterrupted operations and higher customer satisfaction (Shift AI). Even maintenance costs fell by 10–20%, since fewer parts were destroyed by running them to failure.

The raw data from these sensors does not magically morph into actionable insights. That is where machine learning enters the picture. Historical data labeled with actual failures is used to train algorithms—ranging from simple regressions to deep neural networks or random forests—to identify patterns that typically precede breakdowns (Journal of Informatics Education and Research). Perhaps a refrigeration truck’s compressor exhibits temperature fluctuations beyond a certain threshold, and that anomaly is a strong predictor of a fault within days. Once the model has learned these warning signs, it can assign a probability of failure or even estimate a part’s remaining useful life (RUL).

Fleet managers receive alerts like, “Truck #203 has an 85% likelihood of engine coolant failure within 10 days.” By addressing such alerts promptly, they can preempt unplanned outages. Some forward-looking organizations even maintain digital twins: virtual replicas of their assets that update in real time based on sensor data. These twins can simulate wear and tear under various stress conditions, helping predict exactly when a component will degrade to the point of imminent failure. In many cases, the machine learning approach outperforms even the most experienced technicians because it can juggle non-linear interactions among dozens of variables. What might look like random chatter in sensor readings to the naked eye could stand out as a red flag to an algorithm that has pored over thousands of historical breakdowns.

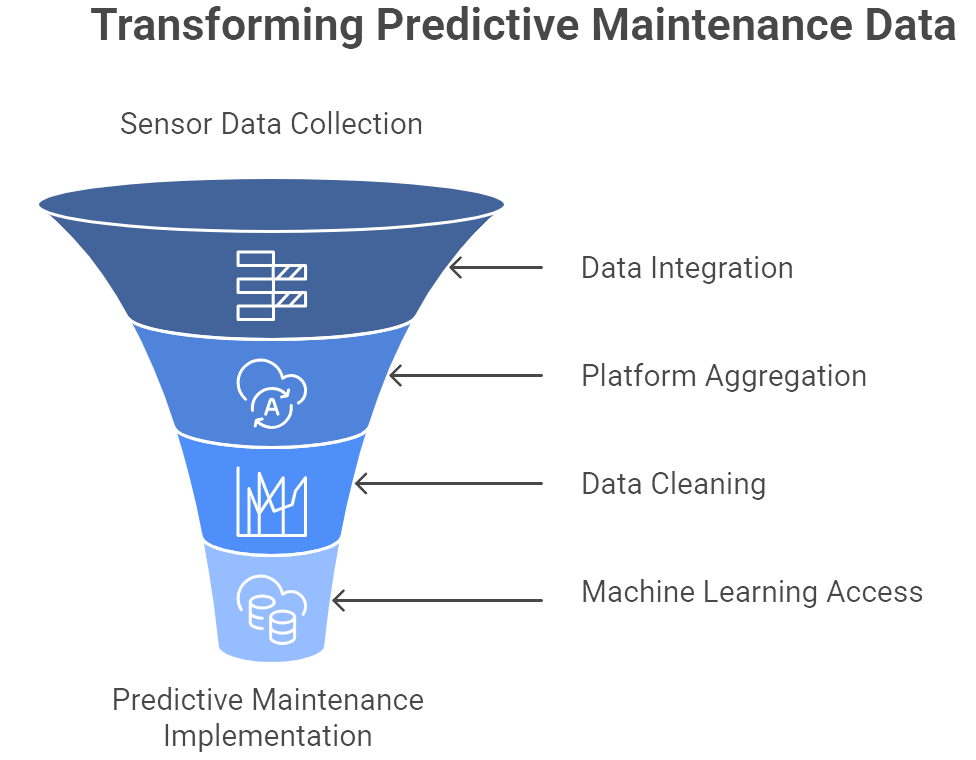

Figure 4: Illustration of the process of transforming sensor data into actionable predictive maintenance insights through data integration, aggregation, cleaning, and machine learning access. (Image by Napkin).

Turning predictive maintenance from a buzzword into a daily reality is both a technical and cultural endeavor. The technical part starts with comprehensive data integration. Sensor data from trucks, forklifts, or conveyor belts often resides in different silos, and maintenance logs might be locked away in an old ERP system. Aggregating these inputs into a single platform—often a cloud-based data lake—ensures that the machine learning models have access to a rich, clean dataset (Boost Efficiency with Predictive Maintenance in Supply Chains). Time-stamped events must align, units of measurement should be consistent, and outliers or missing values require careful handling.

Another success factor is choosing high-impact use cases. Not all failures warrant predictive maintenance. If a conveyor belt jam is trivial to fix, it may not justify the overhead of building a complex model. But if tire blowouts on highway trucks lead to massive delays and disgruntled customers, that is a prime candidate for sensor instrumenting and AI analysis. Domain experts—like veteran mechanics or warehouse engineers—are essential allies. They can help interpret model outputs, refine sensor thresholds, and spot false positives. An AI alert might say, “This part is about to fail,” but human expertise can confirm whether that alert is credible. Over time, the feedback loop between the model’s predictions and the outcomes of subsequent inspections refines the model’s accuracy (Boost Efficiency with Predictive Maintenance in Supply Chains).

Finally, there is the human element: training the maintenance and operations teams to trust (but verify) algorithmic insights. If too many alerts prove baseless, these teams may revert to older habits. Conversely, if management continues enforcing rigid, time-based maintenance regardless of predictive analytics, the initiative might wither from lack of use. The solution is a balanced approach. Early on, companies can overlay predictive insights on top of existing schedules, adjusting them only when the model seems confident of an impending issue. As trust grows and the model’s accuracy proves itself, many routine checks can be phased out, freeing staff to tackle more critical tasks. One logistics provider that fully embraced this approach reported a 15% drop in overall maintenance expenses, crediting improved alignment between AI predictions and actual servicing (Boost Efficiency with Predictive Maintenance in Supply Chains).

Predictive maintenance may seem like the domain of advanced tech players, but its impact is directly relevant to anyone tired of seeing trucks sidelined by mechanical meltdowns or production lines halted by jammed belts. By harnessing sensor data, machine learning, and a clear strategy for implementing changes, logistics organizations can shift from reactive, last-minute repairs to a more proactive, cost-effective approach that keeps shipments flowing. The transformation is not solely about technology; it also reflects a broader shift in mindset—viewing equipment as data-generating assets that can be monitored, learned from, and optimized.

Critics might point out the upfront investment in IoT hardware, data platforms, and staff training. Yet the returns—manifested in reduced downtime, fewer emergency repairs, and extended equipment life—frequently dwarf the initial expense. For companies aiming to compete in an era where delays are not easily forgiven and supply chain disruptions make global headlines, predictive maintenance offers a tangible edge. Like many data science applications, it rewards those who commit to solid data foundations, robust models, and a workplace culture ready to adopt data-driven decisions. Executed properly, this strategy can spell the difference between a seamless logistics network and one that constantly stumbles over mechanical issues at the worst possible moments.

10.5. Inventory Optimization and Demand Forecasting

Inventory is the beating heart of supply chain operations. Stock too much, and watch your warehouse space and working capital vanish like water down a drain. Stock too little, and brace yourself for frantic phone calls from unhappy customers demanding to know why you cannot fulfill their orders. Data science offers a way out of this perennial dilemma by applying analytics, machine learning, and real-time insights to make inventory decisions with surgical precision. It is not magic, nor is it a silver bullet. It is, however, a far more robust alternative to guesswork or perpetually outdated “rules of thumb.”

At its core, inventory optimization is about asking three deceptively simple questions: which products should we carry, how much of each, and where should they be located? The answers have direct implications for service levels, costs, and lead times (Supply Chain Analytics). You can think of inventory as a financial black hole if managed poorly, soaking up capital in the form of carrying costs, insurance, and risk of obsolescence. But run too lean, and you risk costly emergency shipping, production stoppages, and—worst of all—lost sales. Data science transforms these crucial trade-offs into a more calculable game by analyzing reams of historical sales patterns, lead times, and variability.

Consider an example: analytics might reveal that a certain SKU experiences fairly consistent demand with reliable supplier deliveries, so you only need a week’s worth of safety stock on hand instead of three. Conversely, if a product’s demand is highly volatile or the supply lead time is about as predictable as a reality TV star, a bigger buffer at your regional distribution centers might prevent embarrassing stockouts. The upshot is that data-driven inventory management yields measurable gains: you can cut overall stock levels by 20–30% while improving availability, meaning you spend less capital on idle products while still keeping customers happy. By systematically mining sales and supplier data, data science replaces hunches with evidence-based decisions, turning inventory from a necessary evil into a strategic advantage (Supply Chain Analytics).

Inventory optimization rides on the shoulders of accurate demand forecasts. Traditionally, many businesses relied on simple moving averages or seasonal indexes. Those methods can work if your demand patterns are as stable as a Swiss watch. But in modern supply chains, that kind of predictability is becoming rare. Enter advanced time-series models and machine learning. Techniques such as ARIMA, exponential smoothing, or Croston’s method can handle basic seasonality and trends, while more advanced approaches leverage gradient boosting, random forests, or deep learning for volatile demand scenarios (Cogent Blog).

What sets machine learning-based forecasts apart is their ability to incorporate external data: promotions, macroeconomic indicators, weather patterns, even social media sentiment. A model may note that every time the local football team wins a home game, demand for snack products spikes 20% the following day. Basic forecasting tools would be oblivious to that. AI-driven systems also adapt rapidly. Rather than waiting for a monthly review, they spot an unexpected spike in real time—perhaps triggered by a viral TikTok video—and immediately raise future forecasts accordingly. The benefits are legion. With more accurate projections, supply chain managers can scale production or purchase orders, reduce expensive emergency shipments, and minimize the dreaded stockout. A grocery store that uses weather data to anticipate a run on soup and cold medicine before a massive cold front hits is going to outperform one that blindly reorders the same quantities week after week. The net effect of these smarter forecasts is fewer lost sales and less unsold inventory collecting dust in the corner of the warehouse (Cogent Blog).

Inventory optimization does not end once goods arrive at the distribution center. What happens inside that warehouse—where products are stored, how they are picked, and how quickly they move out the door—can make or break a fulfillment operation. AI-driven warehouse management systems (WMS) offer a potent solution. Amazon’s Kiva robots, for instance, autonomously scoot around the warehouse retrieving shelves of items and bringing them to pickers. These robots decide which pod of shelves to move next based on AI algorithms that factor in order priority, robot congestion, and travel distance (AI in Warehouse Management).

For operations still reliant on human workers, machine learning can optimize picking routes in real time, mapping out the most efficient path through the aisles given current traffic or even forecasted order volumes. Computer vision systems can track stock levels via drones or cameras, detecting discrepancies and alerting managers about mis-slotted items. Predictive analytics can forecast daily workloads, allowing managers to schedule labor in a more balanced fashion or redeploy staff to high-demand zones. DHL ran a pilot with AI-based picker routing and saw a 20% bump in picking efficiency, mainly by refining the sequence of picks and paths inside the warehouse (DHL Internal Report 2019). Multiply that by the thousands of orders processed each day, and the time and cost savings become hard to ignore.

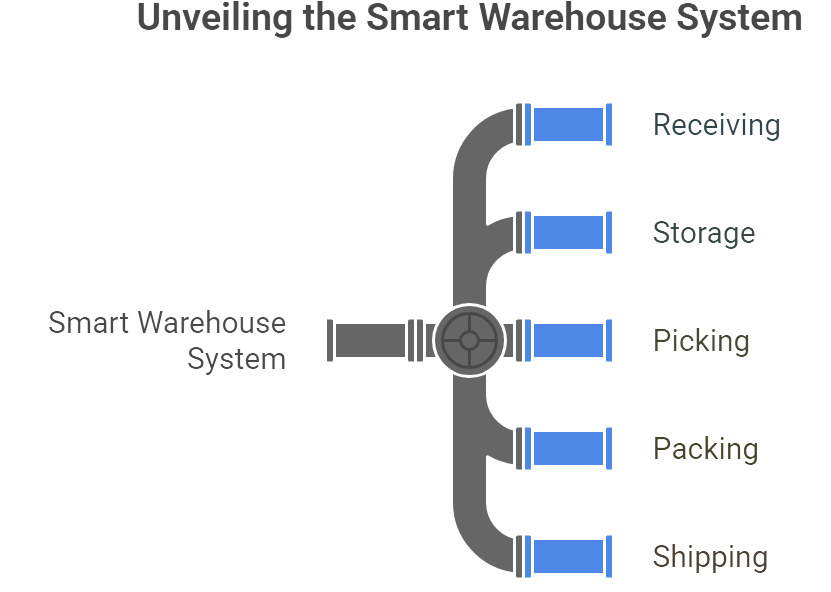

Figure 5: Illustration of the key stages of a smart warehouse system, emphasizing the interconnectedness of receiving, storage, picking, packing, and shipping. (Image by Napkin).

The ultimate goal is a “smart warehouse” that orchestrates receiving, storage, picking, packing, and shipping under a single AI umbrella. It continuously learns from real-time data—sales spikes, seasonal patterns, workforce availability—and adapts accordingly. Instead of forklift drivers guessing where to put newly arrived pallets, the system generates optimized slotting recommendations, grouping items frequently purchased together or placing high-volume SKUs closer to dispatch lanes. The impact is a leaner, faster operation that can handle the kind of sudden surges demanded by same-day shipping or promotional sales events without breaking a sweat.

Balancing inventory levels against fluctuating demand is one of the toughest juggling acts in business. Data science-based methods for demand forecasting and inventory optimization bring a dose of rationality to a domain historically plagued by guesswork and inflexible rules. Whether through time-series analysis, AI-driven forecasting that gobbles up external signals, or intelligent WMS solutions that fine-tune warehouse processes, modern organizations are finding they can trim wasted inventory, reduce rush orders, and keep customers delighted with on-time, in-stock deliveries.

This does not mean implementation is easy. Poor data quality, siloed systems, or resistance from teams used to entrenched processes can derail even the best analytics strategy. Leaders need to champion cross-functional collaboration, ensuring data scientists have access to the right information and that supply chain managers are willing to trust—at least initially—what the model suggests. Change management is critical: a brand-new forecast model that suddenly declares you only need half the inventory you carried last year can trigger fear among conservative operational teams. However, the upside in terms of cost savings, agility, and customer satisfaction is too significant to ignore. Those who fully embrace data-driven inventory management typically discover that once the dust settles, they wonder how they ever tolerated the old status quo. In an era where consumer expectations are skyrocketing and global supply chains teeter under frequent disruptions, the ability to forecast demand accurately and position inventory optimally might be the single greatest competitive advantage you can cultivate.

10.6. Enhancing Supply Chain Visibility and Risk Management

Global supply chains tend to operate like finely tuned orchestras—until a single out-of-sync event turns harmony into chaos. A delayed shipment, an unforeseen factory shutdown, a major weather calamity at a key transportation hub: these events can disrupt the entire network, snowballing into costly emergencies. Data science offers a potent antidote to that uncertainty by illuminating every link in the chain. Through real-time dashboards and predictive analytics, organizations can maintain near-omnipresent visibility, anticipate threats, and ensure that surprises become the exception rather than the rule.

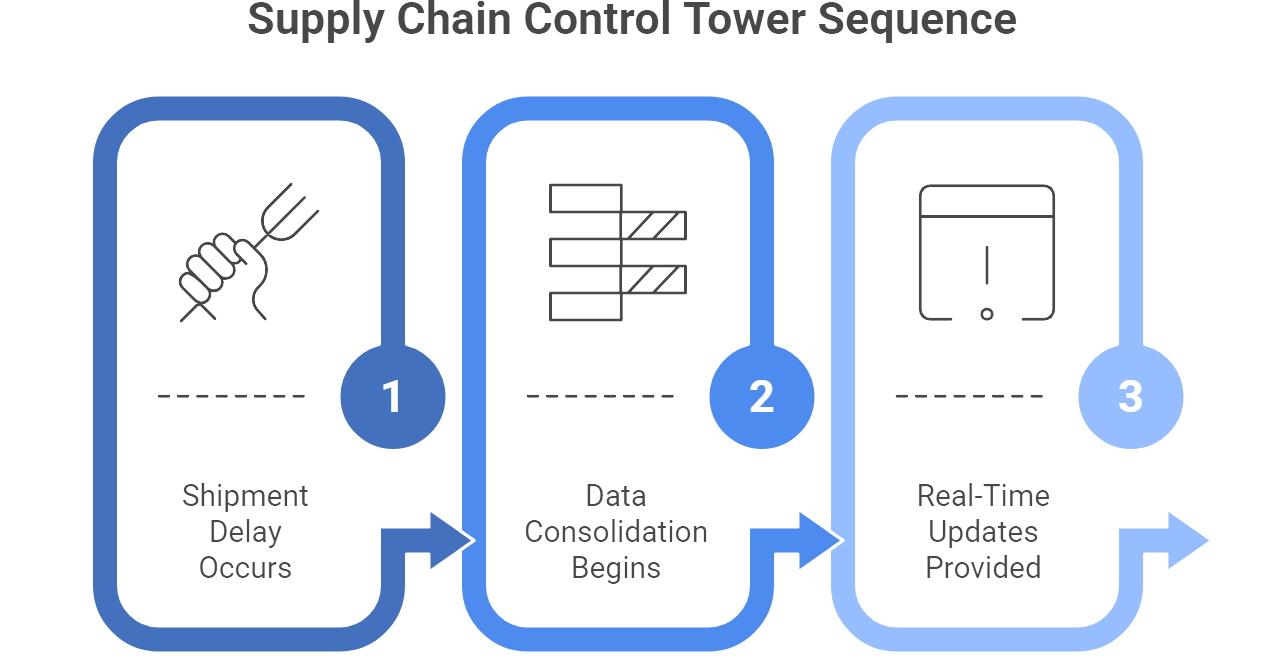

Figure 6: Illustration of the rapid response of a supply chain control tower, showcasing how it transitions from identifying a delay to delivering real-time information for swift action. (Image by Napkin).

Few things are more aggravating than discovering a shipment is late after your top customer calls to complain. A well-designed supply chain control tower prevents these blindsides by consolidating data from internal systems like ERP, WMS, or TMS, as well as external feeds such as GPS trackers and freight marketplaces (The Role of Data and Analytics in Supply Chain Management). The result is a single-pane-of-glass interface that updates decision-makers on inventory levels, in-transit shipments, and potential bottlenecks in real time.

A typical dashboard might display a live map pinpointing every truck’s location and color-coding late shipments. Another screen might show warehouse backlogs, while a side panel tracks production rates at key factories. When a port closure occurs or a manufacturing line stalls, the system triggers alerts before the problem spirals out of control. This heightened transparency not only slashes reaction times but also fosters cross-functional alignment. Procurement, logistics, and sales no longer huddle in separate silos, bickering over who has the “right” data. Instead, everyone sees identical, up-to-date information, ensuring fewer miscommunications and speedier interventions (Supply Chain Visibility (SCV): An Introduction).

The impact can be dramatic. Companies that have embraced real-time visibility platforms often cite higher on-time delivery rates and fewer emergency shipping costs, as they catch potential disruptions early. Control towers can also display sustainability metrics, letting managers track carbon emissions or energy usage per shipment—a useful feature in an era where environmental considerations rank high on corporate agendas. The net effect is a supply chain that behaves less like a black box and more like a transparent, agile operation where data-driven decisions replace frantic guesswork.

Even the most detailed dashboard only tells you what is happening right now. The next frontier—arguably more crucial—is predicting what might happen soon. Supply chains are riddled with vulnerabilities: a labor strike in country X, a typhoon rolling into port Y, a supplier skating on thin financial ice. AI-driven risk management platforms harness a multitude of data sources to forecast these events and propose remedial actions (Machine Learning in Supply Chain: Predicting and Preventing Disruptions).

For instance, an ML model might parse supplier performance metrics—late deliveries, quality lapses, or negative financial trends—and alert you that your second-largest supplier is likely to default within six months. Another system could blend weather forecasts with historical shipping data to estimate that a hurricane in the Gulf has a 60% chance of shutting down a critical route next week. Armed with this foresight, supply chain managers can redirect shipments, secure backup suppliers, or build just-in-case inventory in high-risk regions (Predicting Supply Chain Risk).

Case studies abound. Some companies integrate AI-based risk tools with scenario planning, effectively “stress-testing” their supply chain against hypothetical disruptions (Resilinc, Everstream Analytics). If the model indicates a 30% probability of route closure, it might auto-generate suggestions—like rerouting high-priority orders via air freight. Firms that adopt such proactive risk management often boast fewer shocks and faster recovery times when a black swan event does hit. The message is clear: in an interconnected world, ignoring risk until it bites you is a perilous gamble. AI offers the possibility of peeking around corners, letting you bypass trouble or at least brace for impact well ahead of your less-prepared competitors (Artificial Intelligence’s Role in Supply Chain Risk Management - Everstream Analytics).

In the wake of global events—such as a pandemic that shuttered factories and upended transportation networks—companies with robust, data-driven risk monitoring fared noticeably better. One consumer goods firm famously developed an AI “stress test” for various crisis scenarios. When the real crisis hit, they knew precisely which alternative suppliers to tap and which distribution nodes needed supplemental safety stock. Their on-time delivery rates remained above 95%, while less agile rivals struggled to fulfill orders on time (McKinsey, 2020).

Another electronics manufacturer used a control tower with predictive analytics to reroute shipments mid-transit when a major port jammed up unexpectedly, preventing the dreaded ripple effect of stockouts across multiple plants. Meanwhile, automotive giants like Toyota have long championed supply chain visibility and risk mapping, enabling them to bounce back faster from disruptions such as natural disasters. Today’s AI tools refine and accelerate these practices, making real-time adjustments based on complex data signals that would overwhelm any human planner.

In many cases, the benefits extend beyond just mitigating disasters. Organizations that incorporate real-time visibility and predictive risk analytics into their standard operating procedures often see up to a 10% reduction in overall supply chain costs (Better supply-chain planning with AI and machine learning | McKinsey). They also free up working capital by holding just the right amount of buffer stock—enough to ride out minor hiccups but not so much as to cripple cash flow. The intangible advantage is peace of mind. Executives know that if political unrest flares in a region or a container ship gets stuck in a canal, they have the tools, data, and predictive models to pivot swiftly.

Supply chain disruption is no longer a matter of if, but when. Whether it is a global pandemic, a localized natural disaster, or the sudden bankruptcy of a key supplier, the shockwaves can be devastating for those operating blind. The combination of real-time visibility platforms and AI-powered risk analytics provides a lifeline. Control towers reveal what is happening at every node of the supply chain, while predictive models highlight looming threats and suggest alternative routes or suppliers. Put the two together, and you have a supply chain that can flex and adapt faster than the competition even notices there is a problem.

That does not mean implementing these solutions is simple. Achieving seamless data integration often requires wrangling multiple IT systems and ensuring data quality is not an afterthought. Cultural resistance can also arise, with seasoned managers who pride themselves on “instinct” bristling at the notion that an algorithm might know better. Yet the payoff in agility and cost savings can be remarkable. In a world where customers have zero patience for delays and brand loyalty can vanish overnight, investing in visibility and risk management tools is no longer optional for serious contenders. By shining a spotlight on supply chain operations and anticipating hazards before they escalate, organizations stand poised not only to survive disruptions but to emerge stronger, forging a competitive edge in the process.

10.7. Case Studies Across Key Industries

Supply chains may share common principles—inventory, transportation, forecasting—but each sector has its own quirks and complexities. Data science becomes the universal translator, taking streams of disparate information and turning them into strategic insights, no matter the industry. The following case studies illustrate how data-driven solutions adapt to the unique demands of finance, retail, healthcare, FMCG, and logistics. While the details differ, the underlying theme is the same: organizations harness analytics, machine learning, and real-time monitoring to cut costs, reduce risks, and stay ahead of soaring customer expectations.

Fraud in supply chains often lurks in mundane places: invoices, supplier contracts, accounts payable. Traditional audits and spot checks catch some infractions, but today’s enterprises are relying on data science to spot anomalies at scale. Procurement fraud—where fake invoices, duplicate payments, or collusion with favored vendors quietly siphon millions—has become a top concern. Machine learning models now sift through vast volumes of transactional data, hunting for signals like identical invoice amounts submitted on consecutive days, or a low-volume supplier suddenly billing 10x its normal amounts (Journal of Informatics Education and Research).

One global manufacturing firm discovered that AI-based spend analysis flagged a suspicious vendor relationship that slipped past conventional controls, ultimately saving the company millions. Banks also have a vested interest in detecting fraudulent letters of credit or invoice factoring requests. By cross-referencing shipping manifests, contract terms, and payment histories, AI systems can generate risk scores that highlight transactions requiring human review. The result is higher transparency, reduced financial leakage, and peace of mind for CFOs worried about crooked dealings that might torpedo carefully managed budgets.

Retailers frequently operate on razor-thin margins while juggling wildly fluctuating consumer tastes. Data science has proven indispensable in demand forecasting. Walmart, for instance, merges data from its grocery app, in-store purchases, and external signals (such as local events or weather predictions) into AI models that can anticipate not only product demand but also preferred delivery modes (pickup versus delivery) (Supply Chain Dive). Another example is Target, which customizes its store assortments at a granular, neighborhood level. If data suggests an unexpected spike in beachwear demand along certain coastal areas—even outside typical summer months—Target’s ML systems automatically adjust assortments and reorder points.

Warehouse automation takes these gains a step further. Amazon’s robotic distribution centers leverage AI to orchestrate an army of autonomous robots that fetch shelves and bring them to packers, drastically cutting the time employees spend walking. Similarly, Ocado’s automated grocery fulfillment centers in the UK employ fleets of robots skimming over a grid system, each guided by AI to optimize travel paths and avoid collisions. Some retailers report slashing order fulfillment times from hours to minutes, which can be the difference between a profitable online operation and one overwhelmed by labor and logistical costs. Retailers that have embraced these data-driven approaches often cite a 2–3% boost in sales from improved in-stock positions, coupled with a 20% drop in surplus inventory (The CDO TIMES). In an industry where waste, markdowns, and unhappy customers are daily threats, AI-based solutions can prove decisive.

When a supply chain handles life-saving products under strict regulatory oversight, every minute and every degree counts. Cold chain logistics, integral for vaccines, biologic drugs, and certain lab samples, has been revolutionized by IoT sensors and real-time dashboards. Organizations attach temperature and humidity trackers to shipments, updating cloud-based systems at regular intervals (McKesson). If a vaccine shipment deviates from its required temperature range, the system pinpoints the exact location, time, and impacted doses. Rapid responses—such as re-icing or rerouting—can salvage products that otherwise might be lost.

Hospitals also embrace data science to manage intricate inventory demands. Predictive models that incorporate surgery schedules, patient admission forecasts, and historical usage data can dramatically reduce shortages (or overstock) of essential supplies. One hospital might discover it consistently runs short on orthopedic implants every Monday, leading to a flurry of costly last-minute orders. Machine learning systems that track patterns in patient admissions can automatically recommend adjusting PAR levels for the relevant surgical instruments. This not only cuts waste (especially for expensive, short-shelf-life items) but also improves patient outcomes by ensuring critical supplies are always on hand. During the COVID-19 pandemic, health systems with robust data visibility often avoided crippling PPE and ventilator shortages by redistributing resources internally, guided by real-time usage dashboards. In short, data science in healthcare supply chains can be a literal lifesaver.

Fast-moving consumer goods operate on a fine line between high turnover and potential product spoilage. Demand can skyrocket when a product goes viral or plummet if consumer sentiments shift. Data science helps FMCG firms both anticipate demand swings and manage perishable inventory so it lands in customers’ hands before expiration. Advanced demand sensing merges machine learning with near real-time POS data. For instance, a dairy company might feed daily sales figures from dozens of retailers into an AI model that detects a spike in yogurt purchases in a particular region, automatically prompting increased deliveries while the demand wave lasts.

Meanwhile, perishable inventory management depends on time, temperature, and shelf-life data. A European grocer used sensor logs from farm to store to model produce degradation rates, adjusting order sizes and in-store temperatures to cut waste by nearly 30% (The Ecomm Manager). Another approach, known as dynamic pricing, sees AI algorithms systematically marking down the cost of soon-to-expire items to maximize sales while minimizing waste. The net effect: fresher goods for consumers, less environmental impact from spoiled food, and healthier profit margins for the retailer. FMCG giants like P&G and Unilever have also turned to data-sharing agreements with their suppliers and distributors, dampening the notorious bullwhip effect, wherein small retail-level demand changes can translate into massive manufacturing-level swings.

Last-mile delivery consistently ranks as one of the most expensive, complex stages of e-commerce fulfillment. Truck congestion, unpredictable customer availability, and the push for ever-faster delivery windows make it a hotbed for AI innovation. Major players like UPS, DHL, and Amazon Logistics employ dynamic routing algorithms that continuously recalculate driver routes based on real-time traffic, order volume, and even driver performance patterns. UPS’s ORION system, for example, shaved millions of miles off annual travel by optimizing each driver’s daily route. A newer version, called Dynamic ORION, can pivot mid-route if a sudden deluge of orders appears in a particular zip code (UPS adds dynamic routing to ORION, saving 2-4 miles per driver).

Delivery time predictions get a similar AI boost. Amazon’s algorithms adjust customer arrival times down to the minute, updating your order status if the driver picks up an unexpected extra package or if traffic thickens unexpectedly. For crowd-sourced delivery models (like Postmates or Uber Eats), machine learning determines which driver is best for each request, balancing speed, cost, and driver availability in real time. Some logistics companies are also piloting drones and autonomous vehicles, with AI systems responsible for navigation and drop-off point identification. The aim is to wring out every ounce of inefficiency from last-mile logistics, satisfying consumers’ hunger for near-instant deliveries while curtailing the ballooning costs that plague less-optimized operations (FarEye). Moreover, these solutions often help slash carbon emissions, pleasing regulators and environmentally conscious customers alike.

Data science in supply chains has graduated from novelty to necessity. Whether it is detecting subtle signs of invoice fraud in finance, forecasting retail demand with machine-like precision, delivering life-saving drugs to a remote hospital at a precise temperature, or optimizing last-mile delivery for impatient online shoppers, analytics and AI are reshaping how goods move, how risks are managed, and how businesses remain competitive. Each sector faces its own nuances, but the overarching lesson is consistent: harnessing data can simplify even the most labyrinthine supply chains, turning potential chaos into a source of strategic advantage.

Implementing these technologies, of course, requires more than just technical proficiency. Success depends on data quality, organizational buy-in, and a culture that trusts machine-driven insights enough to adjust ingrained processes. Yet the benefits are hard to deny: cost savings, sharper forecasting, reduced waste, and stronger customer loyalty. In a volatile global economy, these perks often distinguish resilient, forward-looking enterprises from those perpetually playing catch-up. By studying the experiences of finance, retail, healthcare, FMCG, and logistics, executives can glean proven tactics and pitfalls, accelerating their own data-driven transformations and fortifying supply chains against the next wave of disruption.

10.8. Future Trends in Data Science for Logistics

Where once supply chains advanced through incremental refinements—slightly better routes, marginally smarter stock policies—they now face quantum leaps fueled by data science. The horizon is dotted with intriguing possibilities: distributed ledgers that promote radical transparency, AI systems that autonomously orchestrate logistics from end to end, and sustainability initiatives that turn dashboards green while maintaining financial viability. This final section examines three emerging focal points—blockchain, autonomous supply chain management, and green logistics—to illustrate how data science will likely reshape logistics over the next decade.

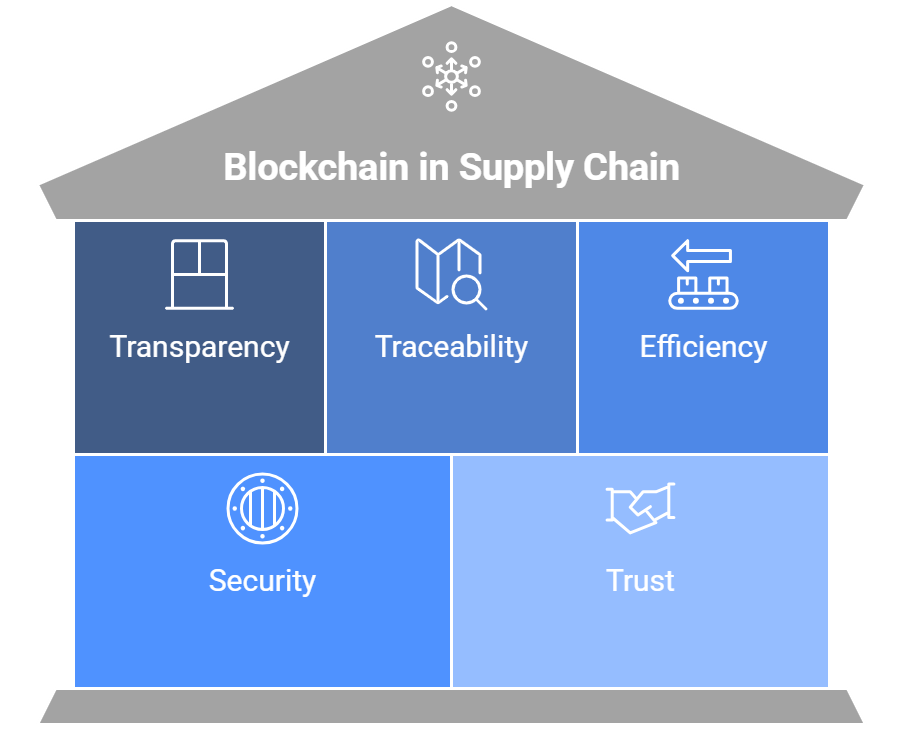

Blockchain, in all its hype and potential, is making a play for mainstream logistics. At its core, blockchain is a decentralized, tamper-proof digital ledger that records transactions in a chain of blocks. Once data is written, altering it retroactively becomes practically impossible. Advocates argue that this level of permanence and transparency is a godsend for supply chains riddled with misplaced trust, counterfeit goods, and messy paperwork (Blockchain for Supply Chain: Uses and Benefits).

Figure 7: Illustration of blockchain's value in supply chain, showcasing how it builds a strong foundation of transparency, traceability, and efficiency, fortified by security and trust. (Image by Napkin).

Imagine every handoff of a product—manufacturer to ocean freight, freight to distribution center, distribution center to retailer—written into a single, immutable chain. A supplier claims goods are ethically sourced or organic? Check the ledger. A retailer wonders if a container really left the port on time? Again, check the ledger. Some diamond retailers already employ blockchain to prevent so-called blood diamonds from infiltrating global markets. Walmart famously tested IBM’s Food Trust blockchain to pinpoint a shipment of mangoes in under two seconds—a task that previously took more than six days with traditional records.

Beyond transparency, blockchain opens doors to smart contracts, which could automate payments and reduce disputes. A carrier might receive payment the instant IoT sensors confirm delivery—no 30-day wait, no awkward phone calls about missing paperwork. In a perfect world, all supply chain partners sign onto a shared blockchain, trusting the platform’s cryptographic security instead of each other’s paper logs. The biggest barrier remains adoption: it is far from trivial to get every participant (including small suppliers) onboard with new technology and maintain consistent data integrity. Early successes, however, underscore blockchain’s potential to help brands prove ethical sourcing, deter fraud, and offer consumers detailed provenance data through a simple QR code scan.

The phrase “self-driving” conjures images of autonomous cars zipping around city streets. But self-driving supply chains? That is precisely where data science is headed, with AI systems increasingly making real-time operational decisions that once demanded legions of human planners. The vision is a network where machine learning models sense demand shifts, automatically adjust production, reroute inventory, and even negotiate spot freight rates—barely pausing for human approval (Better supply-chain planning with AI and machine learning | McKinsey).

A handful of consumer goods companies are already experimenting with partial autonomy. If an AI detects a 10% spike in product demand, it might prompt an upstream supplier to expedite raw materials while simultaneously scheduling additional trucking capacity. All of this happens without a human orchestrator in the middle. The business case is compelling: McKinsey research shows that early movers in autonomous planning have boosted revenue by up to 4%, trimmed inventory by 20%, and shaved supply chain costs by 10%. The logic is simple: machines handle vast complexity and shifting constraints faster and more consistently than human teams can.

On the hardware side, autonomous vehicles, drones, and robotic forklifts are inching closer to practical deployment. Startups are testing self-driving trucks for long-haul routes, yard operations are increasingly managed by AI-driven tugs, and drones handle both last-mile deliveries and warehouse inventory counts. One might envision a scenario in which a distribution center runs overnight with minimal human staff—robots picking orders, driverless forklifts restocking pallets, and an AI “conductor” adjusting operations based on real-time data feeds. Generative AI, the newest kid on the block, may soon play a role in scenario planning, generating rapid network reconfigurations after a port strike or an unexpected demand surge.

Of course, letting AI run the show raises trust and governance issues. Executives must define fail-safes, threshold alerts, and compliance checks to ensure the algorithm’s decisions align with corporate and ethical standards. Yet as the technology matures and success stories accumulate, a future of mostly autonomous supply chain operations no longer appears like sci-fi daydreaming. It stands poised to be the next major leap, similar to how CRM software once revolutionized sales management.

Sustainability has emerged as a dominant concern for brands, regulators, and consumers alike. Carbon footprints, fuel efficiency, and waste reduction are no longer afterthoughts. They are front-and-center topics at board meetings and investor briefings. Data science plays a pivotal role in bridging the gap between lofty environmental goals and operational realities.

For starters, analytics enables rigorous carbon tracking. Companies integrate telematics data, route planning software, and load efficiency metrics to calculate emissions at a granular level. This level of visibility reveals the “dirtiest” segments of a transport network, prompting route optimization or consolidation efforts. UPS’s ORION platform, for example, famously saved 10 million gallons of fuel and cut 100,000 metric tons of CO₂ annually, effectively turning cost savings into an environmental win (AI Case Study | UPS saves over 10 million gallons of fuel and up to $400m in costs annually with advanced telematics and analysis).

Data science also drives mode shifts and alternative fuels. By analyzing total costs, transit times, and emissions data, some firms are shifting freight from trucks to rail or sea, or adopting electric vehicles in well-suited urban areas. AI helps solve range and charging logistics for electric fleets, ensuring that vehicles do not run out of juice en route. Another dimension is packaging optimization. Machine learning algorithms can propose box sizes and materials that minimize wasted space, slashing shipping volumes and thereby emissions. Reverse logistics, crucial for a circular economy, also gains from data science. Predictive models can forecast return rates, helping position refurb or recycling facilities closer to end users, cutting the carbon impact of shipping returned goods across the country.

While skeptics might point out that many green initiatives are PR stunts or compliance-driven, the truth is that sustainability often aligns with cost efficiency. Less fuel burned, lighter packaging, fewer empties in trucks—these factors make financial sense. As government regulations tighten around emissions, and as consumer sentiment increasingly favors eco-friendly brands, supply chain analytics becomes the linchpin that allows businesses to reduce their footprint without sacrificing profitability. In the not-too-distant future, carbon dashboards may be as common as cost dashboards, and logistic managers will face carbon quotas as real as any budget constraint.

Supply chains have always been about coordination and optimization. What sets the upcoming decade apart is the scope and sophistication of the tools now available. Blockchain offers a leap in trust and transparency, AI promises a transition from automated tasks to fully autonomous networks, and sustainability is becoming an operational imperative rather than a mere corporate slogan. For executives, this evolution demands not just investment in technology but a willingness to rethink entrenched processes, build robust data infrastructures, and foster a culture that embraces continual experimentation.

Getting all suppliers to adopt blockchain or trusting an AI to handle major planning decisions can feel risky. Yet history suggests that early adopters stand to reap outsize rewards, while laggards scramble to catch up. The cost pressures of e-commerce, the climate crisis, and rising consumer expectations mean that incremental improvements may not be enough. Whether it is forging unstoppable brand loyalty by guaranteeing ethically sourced, verified products, or halving logistics costs with self-driving operations, the future belongs to those who fuse data science with bold strategic vision. In short, the stage is set for logistics to undergo a revolution that is part digital, part autonomous, and increasingly green—a transformation driven and guided by data.

10.9. Future Trends in Data Science for Logistics